Our LAAP program was designed to help motivated, customer service minded individuals make a long-term career shift as a Licensed Insurance professional. We recognize how difficult it can be to start a career with little-to-no relevant industry experience, so we developed this program to help take some of the stress out of the process while accelerating your path into a new lifelong career!

Producer/Solicitor

Contact Center

Field Agent

Claims Adjuster (FNOL)

Producer/Solicitor

Contact Center

Field Agent

Claims Adjuster

Guaranteed job placement at a National Insurance Provider upon successful exam completion

All licensing material and exam costs covered! ($500+ value)

Comprehensive Health, Dental, and Vision benefits upon job placement

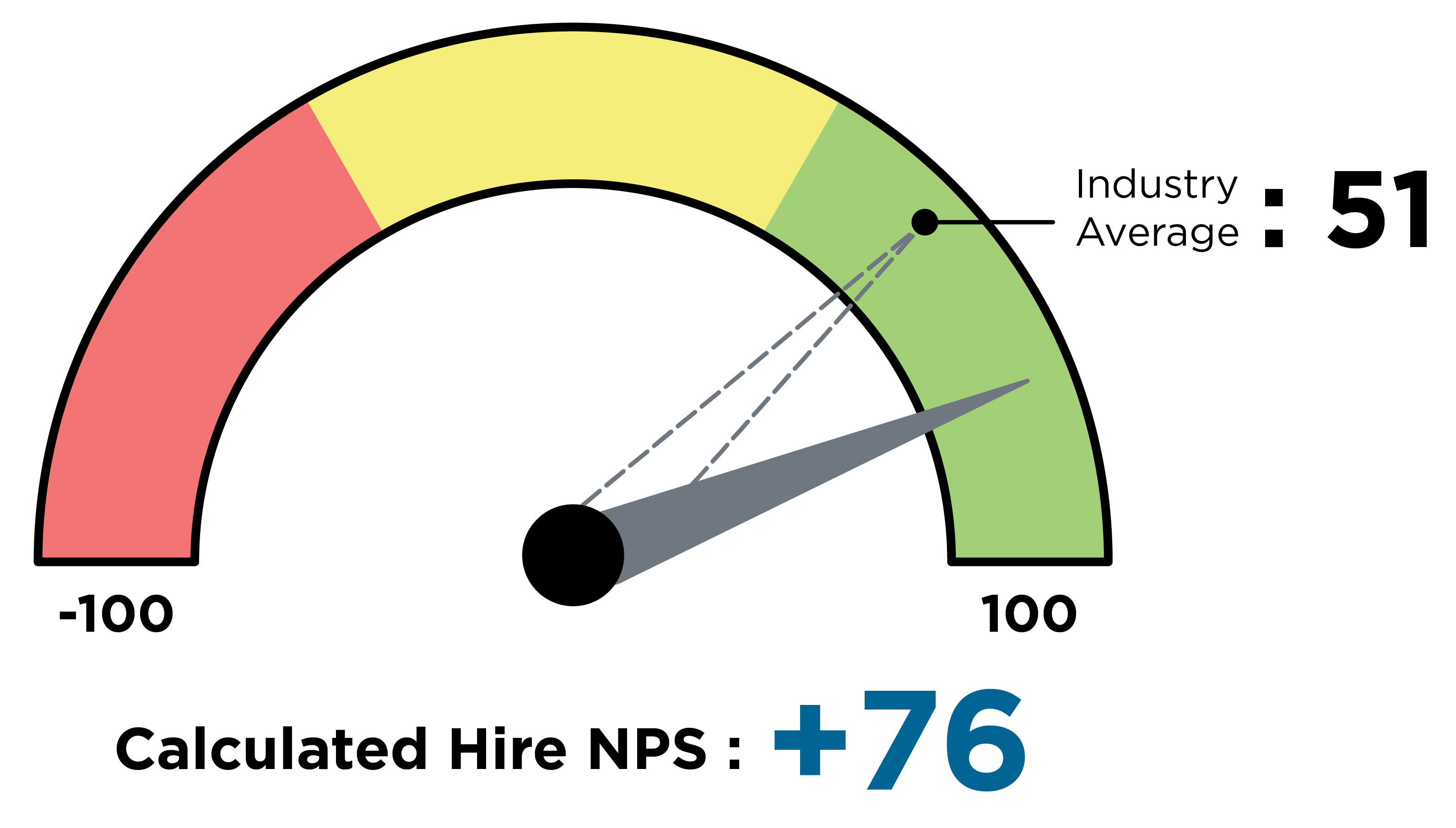

24/7 support from Calculated Hire’s team during licensing process and first 6 months of job placement

Career Matchmaker

Client Interview

Begin Licensing Process

Job Placement

On-Going Support

We want to learn all about you and your career goals and aspirations to ensure we are pairing you up with the best company culture fit.

Just like we meet with you to understand what’s going to be a good fit, we want you to also interview our clients so you can hear firsthand what their core values are.

The licensing course duration will vary from state to state, but expect your licensing course to take you roughly 50-60 hours to complete. During your licensing course, Calculated Hire will be able to provide daily support to ensure that you are getting the most out of the content and that we’re addressing any knowledge gaps as they come up.

Congratulations – you are now a licensed Insurance Professional at a National Insurance Provider!! For the first six months of your employment, you will be on a contract with Calculated Hire. At the end of the six months, you will seamlessly convert to a full-time employee and begin receiving all of the perks of a full time employee.

We are here to support you! During the six months while you are a contract employee, we want to hear ALL of your feedback. Please tell us all the good, bad, and the ugly things you are experiencing in your training so that we can optimize your training experience.

Career Matchmaker

We want to learn all about you and your career goals and aspirations to ensure we are pairing you up with the best company culture fit.

Client Interview

Just like we meet with you to understand what’s going to be a good fit, we want you to also interview our clients so you can hear firsthand what their core values are.

Begin Licensing Process

The licensing course duration will vary from state to state, but expect your licensing course to take you roughly 50-60 hours to complete. During your licensing course, Calculated Hire will be able to provide daily support to ensure that you are getting the most out of the content and that we’re addressing any knowledge gaps as they come up.

Job Placement

Congratulations - you are now a Licensed Professional at a Fortune 500 company!! For the first six months of your employment, you will be on a contract with Calculated Hire. At the end of the six months, you will seamlessly convert to a full-time employee and begin receiving all of the perks of a full time employee.

On-Going Support

We are here to support you! During the six months while you are a contract employee, we want to hear ALL of your feedback. Please tell us all the good, bad, and the ugly things you are experiencing in your training so that we can optimize your training experience.

As an experience-driven company, we know that each client and consultant deserves an elevated employment experience. We consistently go above and beyond for our clients and consultants from the start of the first meeting to post-employment

Property and casualty insurance agents help clients insure property, such as auto, home, and jewelry, against possible damage or legal liability, and they help them settle their claims. These agents have the unique opportunity to help navigate clients through all the available property and casualty insurance products to help them decide the best way to protect their valuable assets. All states require licensed drivers to carry auto insurance, and mortgage loan companies require homeowners’ insurance, so there will always be buyers. There will never be a time where we don’t NEED insurance agents. This makes property and casualty a good entry-level position for a newly licensed agent.

Like life insurance and health insurance agents, property and casualty insurance agents can be captive or independent.

To get an insurance license, many states require that you take an approved education course. After passing the course, a background check is completed, and you must pass a state exam. We can help you through the process, you’re not in this alone! An application and fee must be submitted to the state for review and approval. If approved, the state issues you a resident state license. Now you’re ready to rock and roll!

The resident licenses can only be used in the state you tested in and hold residency with. Good news though, there’s just a couple of additional steps to get licensed in other states. To handle insurance policies in other states, all you have to do is apply and pay a fee to the respective state. Ready for even better news? You are not required to sit for testing again because your resident license is your golden ticket to getting the other state licenses. These licenses are called non-resident or reciprocal licenses.

A license gives you access to all the opportunities a career as an insurance agent has to offer! You must obtain a license in order to review health, life, and/or property and casualty insurance plans in detail. To handle enrollments, you must hold an insurance license – it is state law. The process might seem intimidating, but we’re here to provide you with all the support you need. We are in the business of connecting people to opportunity!

Clean background? You won’t have to wait long! Some states approve applications in a single day, but others can take upwards of three weeks for those without a clean background.

Most states expire after about two years. To renew your resident license, you must complete continuing education courses approved by the state, then submit a renewal application with the fee. For non-resident states, you just submit the application and fee. If your resident license expires, all non-resident licenses and appointments will be cancelled.

We’re glad you asked! A broker usually can represent multiple carriers at once. Agents on these programs have many more certifications and appointments to obtain to become fully RTS than the single carrier agents.

All states have a department of insurance website that allows you to check license and appointment statuses. Another helpful website is NIPR.com, which is the National Insurance Producer Registry. Take a moment to check it out! This is where you can update all states with your current demographic information, submit renewals, find out state specific contact information, and get more resourceful information.